If You Think Your Insurance Covers Like Paint, Where is it Blistered and Peeling?

Recently, the Preferra Insurance Company RRG, (“RRG”) conducted a proprietary market research study of certain competitors’ professional liability insurance policies. We uncovered some alarming findings. They metaphorically equate to what you think you see as a freshly painted house; but up close, it is really a peeled paint blistered mess.

The Case of the “Crazed Contractor”

Do you employ or intend to employ a contractor in your practice? If the answer is yes, you better read about this lawsuit that recently occurred. A claim was made against a Professional Liability Insurance policyholder of the Preferra Insurance Company RRG, who defended and adjudicated this case.

General Liability – Chapter 2

In August 2019, we published our “General Facts About General Liability” Tip of the Month. Since then, there has been a shift in practice methods that we need to address. Spawned by COVID-19, there has been an increase in walk-and-talk sessions and more sessions occurring out of office venues, aside from an increase in teletherapy.

Sexual Misconduct

A male practitioner sent sexually-oriented communications to a mentally and emotionally disturbed female adult client through voice mail, verbally directly by telephone, email, texts, letters, and cards by mail. A blatant case of a clinical setting boundary violation and sexual misconduct with no physical interaction, this indefensible sexual misconduct claim is valid regardless of the lack of physical, sexual interaction.

Would You Buy a Raincoat Full of Holes?

A client trips on your waiting room carpet, falls and breaks an ankle. Does your General Liability policy cover you? Maybe! Maybe NOT!

Insurance Tips and Why You Buy

While reflecting on your recent summer vacation, it’s a good time to ask yourself why you buy insurance? Are you looking to comply with a state licensing requirement, a requirement by your employer, or simply your need for protection? Are you only price-driven, or do you evaluate your insurance policy to understand the actual benefits, limits, sub-limits, and value?

Professional Liability Insurance Headwinds and the New Normal in Teletherapy

Client sessions occurring in person will eventually return to normal. But in our opinion, a new normal is sprouting with greater use of teletherapy. Congress is considering legislation to loosen teletherapy restrictions and allow more use of teletherapy across state lines.

Mindful, Watchful, and Careful

Traveling is picking up again as the nation comes out of COVID-19 and as the vacation season approaches. Moreover, some practitioners must travel overnight for work. Whether for work or vacation, traveling has risks even while providing professional services during the day. For your safety, it is important to be Mindful and aware; Watchful: vigilant; and Careful: prudently cautious to avoid danger and harm.

Grocery Shopping With 1965 Prices

Preferra is owned by its policyholders and is not controlled by profit-obsessed Wall Street investors. We strive to take cost out of every aspect of our business while delivering the best coverage in the nation to you at the lowest price, along with many free support services. Our record proves it—no price increases in over 45 years.

Insurance and the Numbers

Insurance is all about numbers and using numbers and statistics to predict outcomes. That is because some people say that insurance is like gambling. Why is that? While similar to gambling, however, insurance is not a zero-sum game where the dealer wins the bet and you lose.

Assortments of Endorsements

Just about any insurance carrier allows the buyer of an insurance policy or an active insured covered under an insurance policy to buy a “Rider,” referred to as an “Endorsement.” When you add an Endorsement to an insurance policy contract, think CHANGE. It could amend anything.

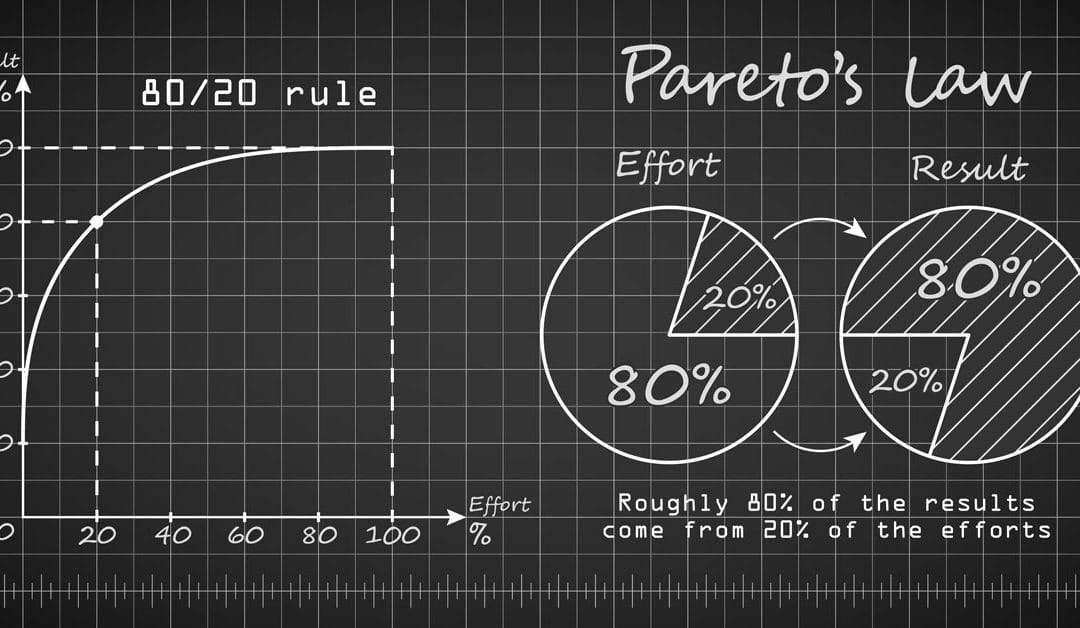

Ratio to Pareto…What’s Best for You?

Today we will talk briefly about certain statistical tools and perspectives that you may want to use in your practice so you get a better handle on your cases and general work activity. The goal here is to help you work smarter, not harder while managing your risk better. The first thing to ask is: “What’s my story?” Is your practice driven by a few types of cases or is it widespread among many diverse case types?